The Pain Could Be Ending in This Hated Market

Chinese tech companies have had it rough recently…

In the previous decade, they were the envy of the world. They had been on the way to dominating the world’s largest consumer market. And they could basically grow unchecked.

But things changed in late 2020…

That was when China’s leader Xi Jinping started to put the entire sector under intense regulatory scrutiny. The Chinese government was worried that these companies were becoming too big and powerful. Throughout 2021 and 2022, it cracked down hard.

For example, online-shopping titan Alibaba (BABA) could no longer stop merchants from selling products on other e-commerce platforms.

Innovative online-tutoring businesses suddenly couldn’t charge students for their tuition fees. These companies cater to a huge market of millions of aspiring high school graduates each year.

Online-payment firms, like Tencent’s WeChat Pay, were forced to allow their hundreds of millions of users to access competitors’ services.

Even video-game developers were prevented from publishing their titles for eight months. They also had to limit game time for minors.

The Chinese government handed out massive fines for antitrust violations. Growth collapsed.

It was mayhem. And it was a huge hit on the way Chinese tech companies made money.

As such, it was no surprise that investors soon didn’t want anything to do with these stocks. But as I’ll explain today, the pain in this corner of the market could be winding down…

We can see the carnage in recent years by looking at the KraneShares CSI China Internet Fund (KWEB). It’s a U.S.-listed exchange-traded fund (“ETF”) that invests in the largest Chinese tech stocks.

Since its peak in mid-February 2021, KWEB has fallen about 73%. Meanwhile, the Invesco QQQ Trust (QQQ) – which tracks the tech-heavy Nasdaq 100 Index – is up roughly 28% over the same time frame.

Naturally, many investors are still worried that the same losing trend will continue for Chinese tech stocks.

By the end of 2023, the Institute of International Finance was projecting an outflow of $65 billion from Chinese stocks and bonds in 2024. It would be another bleak year.

The truth is, when it comes to Chinese tech stocks, it’s hard to imagine things getting much worse than they already have. Even by mid-2023, the crackdown showed signs of easing.

Meanwhile, China’s economy continues to chug along. It grew 5.3% in the first quarter alone – beating expectations.

Even before this, companies like Alibaba and JD.com – two of China’s largest tech firms – were posting strong earnings growth when they reported year-end results.

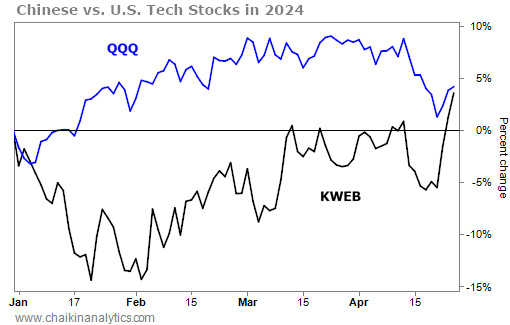

That’s why by now in 2024, KWEB isn’t vastly underperforming QQQ. Take a look…

That’s despite intense pessimism in just about everything we’ve seen in the media about China these days.

When things manage to do this well in the face of extreme negativism, it’s a sign that the “smart money” is starting to creep back in.

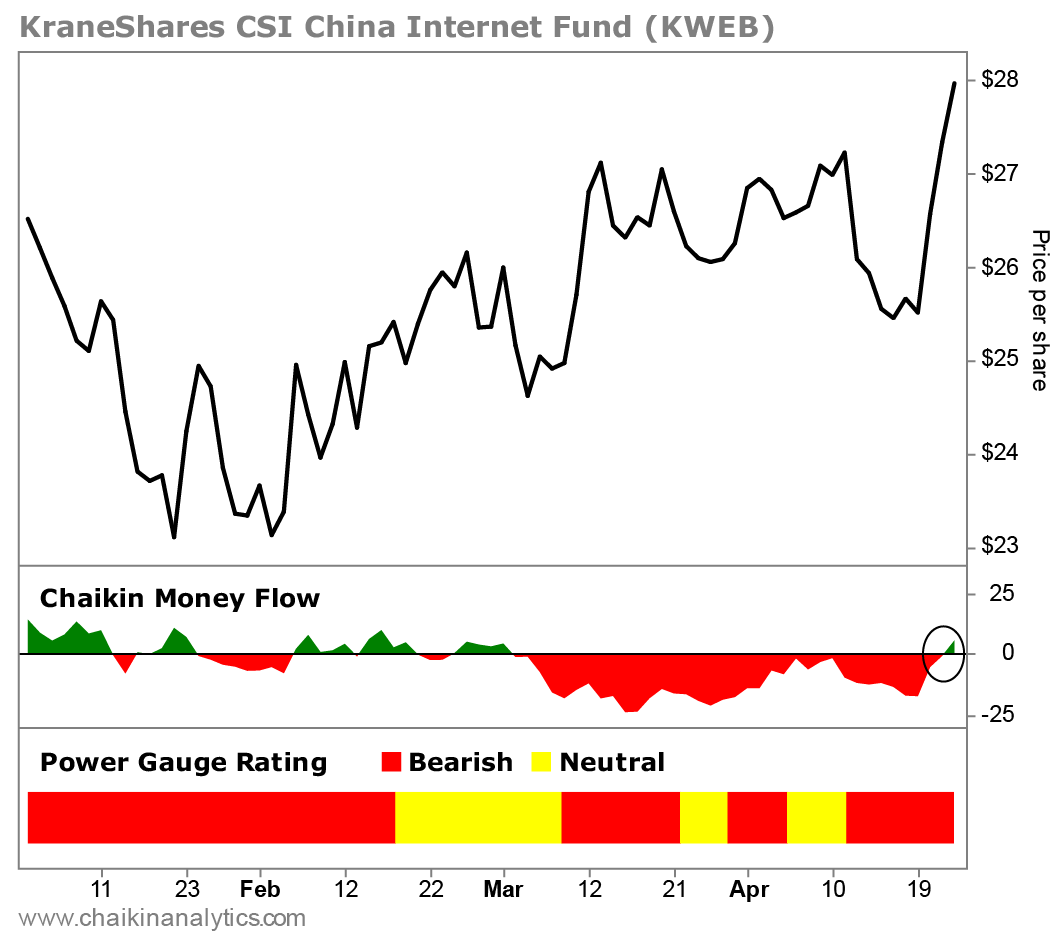

As regular readers know, we can track the smart money in the Power Gauge through our Chaikin Money Flow indicator.

As you can see in the chart below, KWEB’s Chaikin Money Flow has been ticking up recently from being deep in the negative. And it just hit about breakeven. Take a look…

This doesn’t mean that it’s time to rush into Chinese tech stocks…

As you can also see in the chart above, we’ve seen a few of these upticks in KWEB’s Chaikin Money Flow already this year. And the Power Gauge rating is still “bearish” – as it has been for most of 2024.

Put simply, our system is still saying to be cautious right now.

But the recent performance of Chinese tech stocks compared with the Nasdaq 100 this year is telling us investors are starting to pay attention to this corner of the market.

I’ll wait for a stronger overall signal from the Power Gauge. But I’ll have my eye on what happens next with Chinese tech stocks.

Good investing,

Vic Lederman

Recent Articles

Here’s What the Potential TikTok Ban Means for Investors

The U.S. government just approved an aid package for Taiwan, Ukraine, and Israel. But the package had something else attached to it… It included language to force the sale of social media app TikTok. The app could even face a U.S. ban. The media has been all over the story about a possible TikTok ban.

The Power Gauge Is NOT Rushing to ‘Play Defense’

The stock market is in the middle of a rough patch… The benchmark S&P 500 Index fell as much as 5% from its record high at the end of March. And the Nasdaq Composite Index dropped 7% from April 11 through the end of last week. This recent pullback is scaring some investors. These folks

Absurd Car-Dealer Markups Are Fading Into the Past

The latest model of an iconic Japanese sports car turned heads… And not in a good way. In 2022, Nissan launched the newest version of its Z-series car – the 400Z. It’s the seventh generation of the vehicle. The first generation was originally known as the Fairlady Z in Japan. More than half a million

Get Stock Ideas & More, Delivered Daily with Chaikin PowerFeed

Anticipate upcoming market movements, get stock ideas daily, earnings updates, trends, and more! Delivered to your inbox Monday through Friday — 100% FREE.

Receive daily market updates, sector tracking, in-depth industry analysis, earnings updates, and actionable ideas via our Chaikin PowerFeed newsletter.