The Power Gauge Is NOT Rushing to ‘Play Defense’

The stock market is in the middle of a rough patch…

The benchmark S&P 500 Index fell as much as 5% from its record high at the end of March. And the Nasdaq Composite Index dropped 7% from April 11 through the end of last week.

This recent pullback is scaring some investors. These folks worry that a bigger, longer decline could be coming. As Chaikin Analytics founder Marc Chaikin noted last Thursday..

Volatility is back.

It makes sense. After all, a lot of storm clouds are looming on the economic horizon…

Inflation remains high. So in turn, the Federal Reserve is still in a holding pattern. The central bank isn’t lowering interest rates yet.

Consumer credit and auto-loan defaults are on the rise as well. And the unemployment rate is inching up.

My point is simple…

If you look in the right places, it seems like the market is coming apart at the seams.

As a result, some folks want to hunker down and get ready for a prolonged downturn. So they’re searching for the best ways to “play defense.”

But as I’ll show you today, the Power Gauge is telling us to do something different…

Regular Chaikin PowerFeed readers know that Marc expected to see a bout of volatility before the summer. That’s exactly what we’re dealing with right now.

But this pullback doesn’t mean we need to run for the hills.

The Power Gauge helps us see that…

We can use our one-of-a-kind system to look at the so-called “defensive” sectors. By defensive, I’m talking about sectors like utilities, consumer staples, and health care.

The idea is that demand in these three sectors will remain constant no matter what’s going on in the economy. So if the economy struggles, these sectors aren’t as risky as areas of the market that depend on a lot of growth.

In other words, these sectors often provide great ways to play defense.

But we’re not seeing that yet this time…

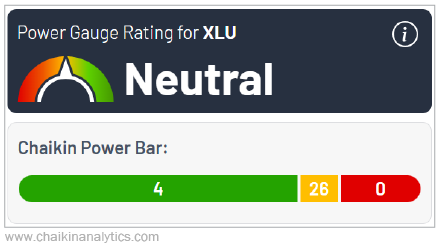

Take the utilities sector, for example. We track this space through the Utilities Select Sector SPDR Fund (XLU). And as you can see in the screenshot below, it’s “neutral” today…

Four of the 30 stocks with Power Gauge ratings in XLU are “bullish” or better right now. None of the ETF’s holdings are “bearish” or worse. And as you can see, most are “neutral.”

Put simply, the utilities sector isn’t screaming “buy” at us right now.

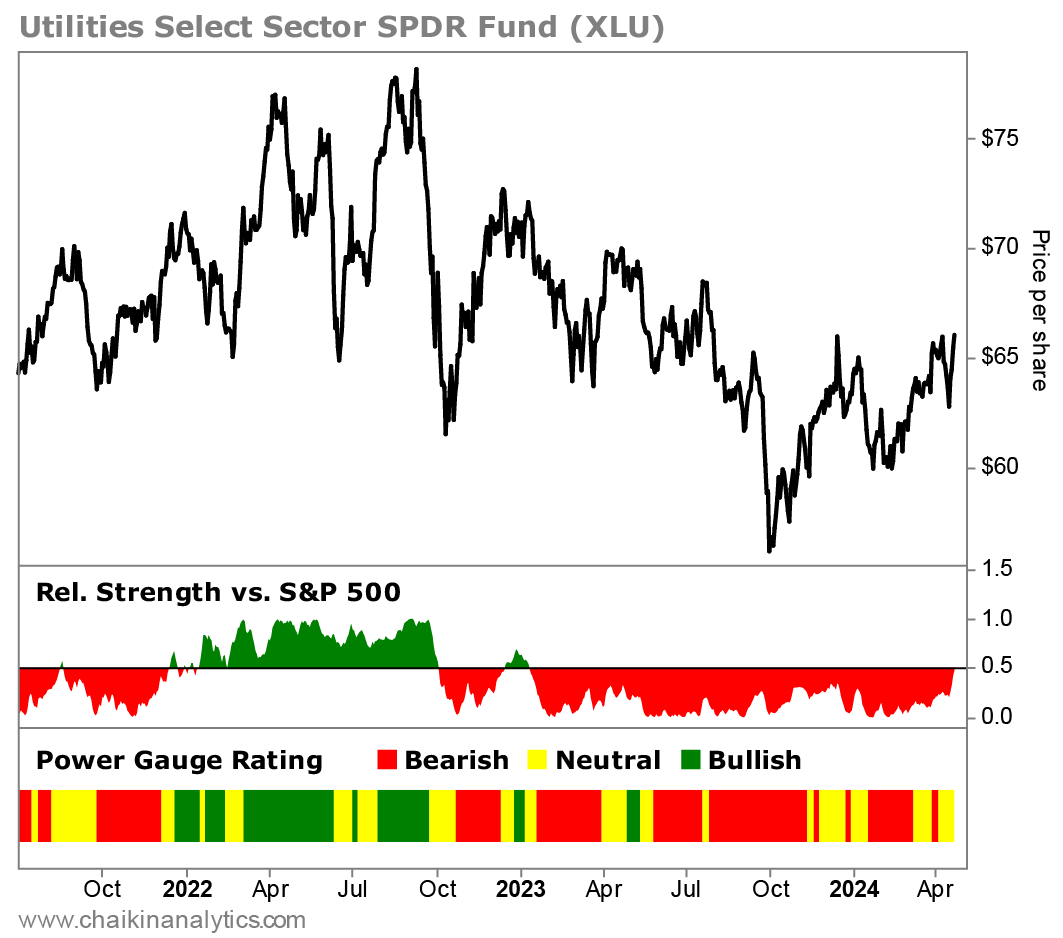

Plus, despite a recent uptick, XLU is still lagging over the longer term

XLU is up around 18% from its October 2023 low. But as you can see, it’s still down roughly 15% from its September 2022 high.

You’ll also notice that the sector has been mostly “neutral” or worse since the end of 2022.

Next, look at the relative strength panel at the bottom of the chart…

XLU has significantly underperformed the broad market over the past 18 months. And most importantly, that’s still true today.

The other defensive sectors tell the same story. The main ETFs for consumer staples and health care both hold “neutral” ratings. And they’re both underperforming the market.

So yes, the broad market is pulling back right now. But the Power Gauge is clear…

It’s not time to play defense yet.

The three main defensive sectors aren’t clear-cut buys today. That’s true despite the recent pullback in the broad market.

So instead, for now, I’ll keep using the Power Gauge to focus on the strongest corners of the market.

By that, I’m talking about the sectors that earn “bullish” or better ratings today.

Good investing,

Vic Lederman

Recent Articles

Absurd Car-Dealer Markups Are Fading Into the Past

The latest model of an iconic Japanese sports car turned heads… And not in a good way. In 2022, Nissan launched the newest version of its Z-series car – the 400Z. It’s the seventh generation of the vehicle. The first generation was originally known as the Fairlady Z in Japan. More than half a million

Consumer Sentiment Just Hit a Multiyear High

Editor’s note: Regular Chaikin PowerFeed readers know we’ve been sharing occasional insights from beyond Chaikin Analytics on why stocks have room to run higher this year… Over at our corporate affiliate Stansberry Research, our friend Brett Eversole has been bullish on stocks for 2024. We’ve previously shared evidence from him on why he thinks so

How I Helped Turn $600,000 Into $20 Million in Just a Few Years

A homeless-looking man with a thick European accent walked in holding a $600,000 personal check… Before that, I was having a normal workday in 1998. I worked as a broker-dealer in those days. My company had several offices around the country. Our branches were typically in towns with a lot of high-net-worth residents. Folks would

Get Stock Ideas & More, Delivered Daily with Chaikin PowerFeed

Anticipate upcoming market movements, get stock ideas daily, earnings updates, trends, and more! Delivered to your inbox Monday through Friday — 100% FREE.

Receive daily market updates, sector tracking, in-depth industry analysis, earnings updates, and actionable ideas via our Chaikin PowerFeed newsletter.